Rob Du Boff explains the findings of JUST Capital’s rankings on the controversial US corporate tax reform.

Since the passage of the Tax Cut and Jobs Act in late 2017, JUST Capital has been tracking what companies are doing with the windfall they’ve received – an estimated $150 billion for the Russell 1000 companies we analyze as part of our rankings. Now that we’re one quarter into this year, we’re looking back on how Tax Reform is shaping the corporate landscape today and how, if at all, the overall allocation of these tax savings aligns with the priorities of the American people.

Based on our 2017 polling of over 10,000 Americans, mapped to the U.S. Census, Workers are seen to be the number one priority when it comes to just business behavior. This is followed by Customers, Products, the Environment, Communities, Jobs, and finally, Management & Shareholder needs. JUST Capital took this lens, constructed from the perspectives of Americans themselves,

and applied it to Corporate Tax Reform – how are companies distributing their savings, and how are the views of Americans reflected in these decisions?

and applied it to Corporate Tax Reform – how are companies distributing their savings, and how are the views of Americans reflected in these decisions?

So far, of the companies JUST Capital analyzes, 133 have announced how they plan to allocate their tax savings – and through our Rankings on Corporate Tax Reform, we’ve evaluated how those allocations measure up to the priorities of the American people.

The short answer? They don’t.

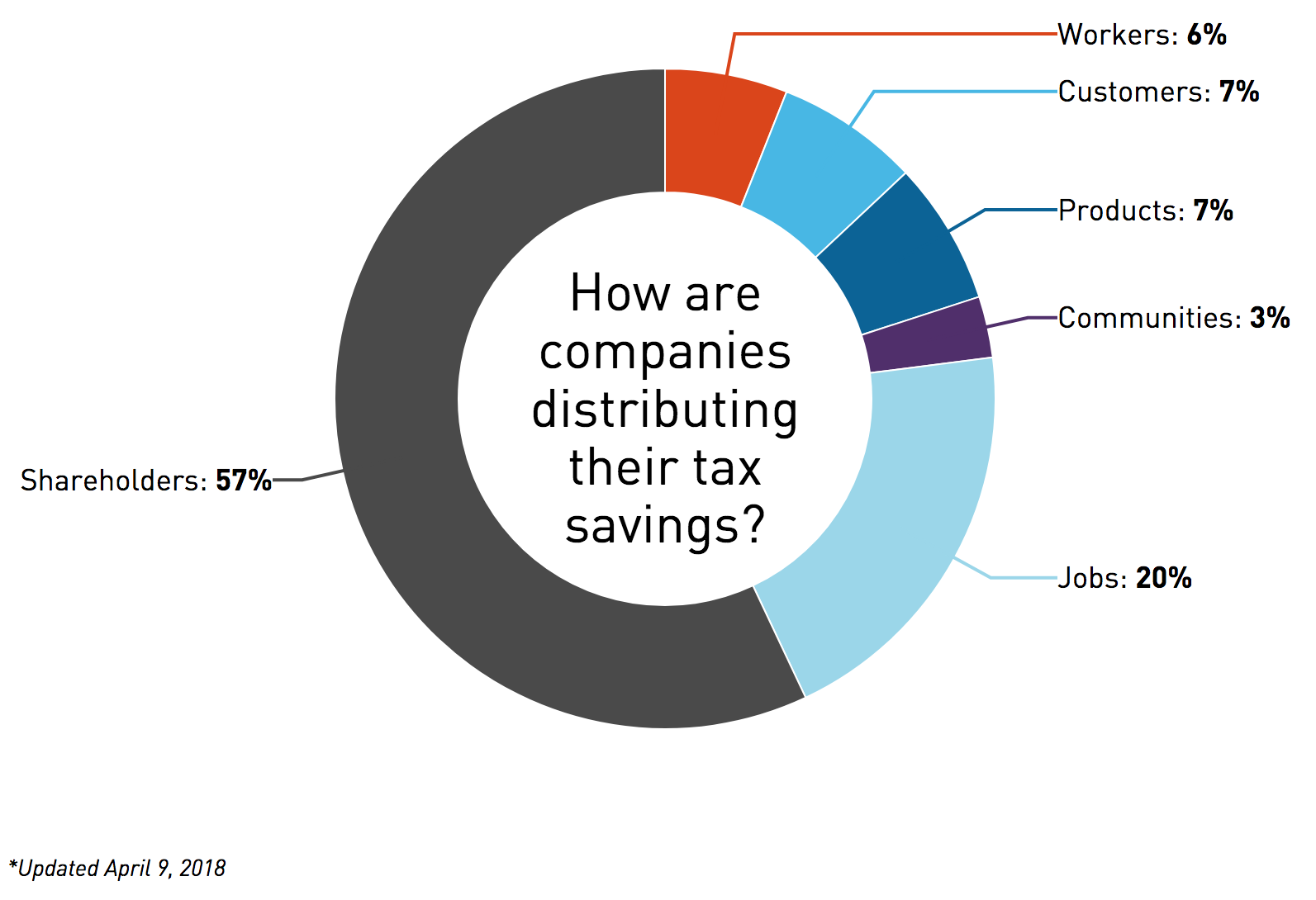

While Americans put Workers first and foremost among their priorities for just business behavior, corporate tax savings have largely passed them by, with only six percent of tax-related income going to Workers – from wage increases to benefits to employee training. Tellingly, more than half of what’s going to workers takes the form of one-time bonuses – as opposed to permanent raises or benefits – suggesting these distributions carry little in the way of long-term impact.

Aside from Workers, JUST Capital is tracking the other key priorities of the American people. 20 percent has been distributed to Jobs, which incorporates job creation as well as capital investment tabbed for job creation. Products and Customers have each been allocated seven percent, and three percent is going toward Communities, encompassing charitable giving, matching employee donations, volunteering, and management of social impact in the supply chain. As of now, no funds have been allocated directly to Environmental initiatives.

We have seen that companies with higher percentages of workers making a living wage tend to invest more in capital projects and R&D (both classified as Jobs), such as Pfizer, which plans to invest approximately $5 billion in U.S. capital projects over the next five years, and Huntington Ingalls, which will invest $1.5 billion in its shipbuilding operations through 2020. These companies also tend to invest in Community initiatives – like EcoLab, which plans to make a $25 million contribution to support communities in which they do business. Companies with lower wages tend direct a bit more toward their workers – for example, Darden Restaurants, Dollar Tree, and Starbucks.

Finally, our research highlights an elephant in the room: specifically the 57 percent of estimated tax savings that remains unallocated. Until intention for these funds is disclosed, JUST Capital allocates the funds toward Management & Shareholders, as they may be used to fund buybacks, dividends and distributions, or additional investment at a later date. In fact, many of America’s largest companies are already considering distributing their tax savings through stock buybacks – potentially upwards of $600 billion in the S&P 500 this year. Additionally, the S&P 500’s quarterly dividend payments set a new record this year, with investors receiving $109.2 billion in dividends since January, an increase of over 8 percent from the $100.9 billion received during the same period in 2017.

As of now, JUST Capital is not incorporating stock buyback authorizations explicitly into our Rankings on Corporate Tax Reform, as they tend to be multi-year programs, and therefore difficult or inopportune to compare to annual spending on workers. Over the course of this year, we will be able to see how much companies are actually spending in cash on share buybacks (as well as dividends and M&A), and will track how this affects the overall distribution.

As we enter the second quarter, the steady stream of announcements has begun to slow but it’s clear investors are likely to be the big winners of the Tax Cut and Jobs Act – to what extent, it remains to be seen. Throughout the coming year, JUST Capital will continue to track how savings are, in fact, distributed, and how different key stakeholders – from workers to customers to communities to investors – reap the benefits.

by Rob Du Boff, CFA, Director of Corporate Research, JUST Capital

COMMENTS