The good news about renewable energy is just not good enough. Companies must take the lead in decarbonisation, says Natural Capital Partners’ Jonathan Shopley.

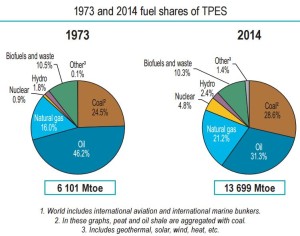

The cost of renewable energy technologies – specifically solar and wind – are falling so fast that in some national markets renewable energy supply has reached price parity with unsubsidised fossil fuel energy. While that sounds like excellent news for the rapid decarbonisation of global energy, the International Energy Agency (IEA) data below shows just how small a share of the total primary energy supply (TPES)[1] is currently associated with non-fossil fuels (~19%) and renewables (<1.5%). We are a long way from a pathway to energy sector decarbonisation.

Source: © OECD/IEA 2016 Key World Energy Statistics, IEA Publishing. Licence: www.iea.org/t&c

Analysis of current primary energy trends by consultants McKinsey explains why that is:

- Energy demand is set to grow at around 0.7% on average per year to 2050 because economic growth in developing economies and a rising global population together outstrip the projected 50% reduction in energy intensity (energy used per unit of GDP) by 2050.

- Even though solar and wind are expected to grow faster than every other source of power, fossil fuels will dominate primary energy demand with a 74% share in 2050 (down from the current level of 82%). That is because the substantial reliability and cost advantages from investments in fossil fuel extraction and fossil fuel energy production over the past half century will need about 20 years or more to be fully depreciated.

As the IEA points out, the energy sector is a long way from decarbonisation, and in the context of the Paris Climate Agreement, there is no evidence that it is yet on a trajectory to keep global average temperature increase to below 2oC.

McKinsey is at pains to point out that the scenario above is an extrapolation of current market trends. It does not necessarily represent what will happen in reality: think about how quickly the information technology market has changed over the past 30 years. Back in the 1980s, the sector was dominated by clunky desktop computers, and the future of massive computing power looked like it was all about the supercomputers that companies like Cray Research Inc. were producing. Fast forward to today: Cray Inc.’s market cap is less than a billion dollars and is dwarfed by Google’s half a trillion. Although Cray still makes supercomputers, the aggregated power of 2 billion smart phones today has transformed the sector beyond recognition. Can the energy sector beat a similar path?

The private sector holds the key to driving energy sector decarbonisation

Two drivers can change the pace and profile of primary energy supply from high to low carbon sources. The first is innovation in the production, storage and distribution of renewable energy. There is plenty of evidence that innovation is proving a strong driver for change. Price parity between solar and wind vs. coal and gas is already with us in certain markets. Power storage that helps make renewable energy available when it’s needed rather than when it’s produced is making great strides. And “small is better” micro-grids are challenging the “big is best” national and regional distribution grids with systems that could become the “smartphones” of energy supply: smaller, more efficient, flexible and cheaper. Tesla’s progress over the past decade in developing, and then combining electric cars, energy storage and rooftop solar in the US, is a case study of the kind of disruptive innovation in technology and business models that could dramatically speed things up.

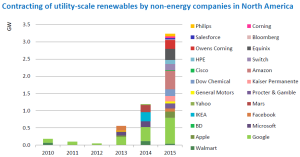

The second driver is demand for renewable energy. Again, the private sector is leading the way. IEA data shows that consumer-led spending in 2015, including distributed solar photovoltaics and corporate buying of renewable energy, comprised over US$50 billion of investment in renewables across the US, Europe and Japan. The chart below shows how some larger, consolidated corporates have invested directly in renewable electricity-generating assets (either on-site or off-site), or used power purchasing agreements (PPAs) to link their consumption of electricity to specific renewable energy providers. The growth trend is impressive, and this strengthening demand signal is likely to spur the rate of change.

Source: © OECD/IEA 2016, World Energy Investment Report, Licence: www.iea.org/t&c; Data source: Rocky Mountain Institute’s Business Renewables Center (2016)

International businesses with more dispersed operations, or smaller businesses with less appetite for the long-term price and supply risks of PPAs, are using market-based instruments to achieve a similar preference for renewable electricity. These include Renewable Energy Certificates (RECs) in the US and Guarantees of Origin (GOs) in Europe. Standards such as the International REC Standard (I-REC) and Tradable Instruments for Global Renewables (TIGRs) are expanding the geographies in which corporates can access internationally recognised, tradable and reliable renewable electricity instruments. PPAs and renewable energy instruments give all businesses immediate access to solutions that allow them to commit to 100% renewable electricity within much shorter time frames than the business-as-usual scenarios would suggest are possible. Demand-side signals from PPA and renewable energy instrument transactions are the fuel that will accelerate innovation and impact in renewable energy provision.

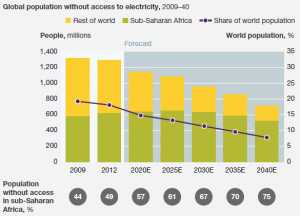

Don’t forget the 1 billion people who will still lack electricity in 2030

Despite the progress, the McKinsey research highlights that about a billion people may still lack access to electricity in 2030. It is critical to build and deliver low carbon solutions as these communities join the first rungs of the energy ladder. Energy efficiency or energy transformation projects, such as clean cookstoves, biogas from farm waste, small hydro and community solar, specifically provide energy access to off-grid communities.

Through carbon finance for greenhouse gas mitigation projects, these activities can contribute to zero emissions targets by offsetting Scope 1 and 3 emissions, in addition to supporting many of the focus areas laid out in the Sustainable Development Goals (SDGs).

Source: Exhibit from “Renewable energy: Evolution, not revolution”, March 2016, McKinsey & Company, www.mckinsey.com. © 2016 McKinsey & Company. All rights reserved. Reprinted by permission.

We have all the tools to break through the business-as-usual barriers

Companies of all sizes, business models and geographic locations have at their disposal cost-effective opportunities to target 100% renewable electricity and zero carbon emissions: combining the power of innovation in renewables, with approaches to meet greenhouse gas reduction goals, while future-proofing the business through a price on carbon. Climate leadership goes even further, extending beyond the direct operational boundaries of the business, to deliver benefits such as access to energy for communities within supply chains and future markets. Companies are seizing the good news about renewable energy, and making an increasingly meaningful contribution to reducing greenhouse gas emissions to levels that will stabilise climate change.

Jonathan Shopley is managing director of Natural Capital Partners. Jonathan has 25 years’ experience in identifying and mitigating environmental impacts from industry. He is regularly invited to represent the view of business at UN COP meetings, and industry events throughout the world.

Natural Capital Partners works with clients to combine business success with positive impact on the environment and society. Through collaboration with global project partners, the development of innovative solutions, and understanding the specific goals of its clients, the company delivers programmes for renewable energy, reducing carbon emissions, enabling water stewardship and protecting biodiversity. Find out more about how Natural Capital Partners helps businesses to achieve their renewable energy goals here.

[1] Primary energy supply includes all energy forms found in nature – non-renewable and renewable – generally measured as Million tonnes of oil equivalent (Mtoe). Secondary energy includes electricity and transport fuels derived from the conversion or transformation of primary energy sources. Energy converted to electricity is generally measured in Megawatt-hours (MWh). 1 toe = 11.63 MWh.

COMMENTS